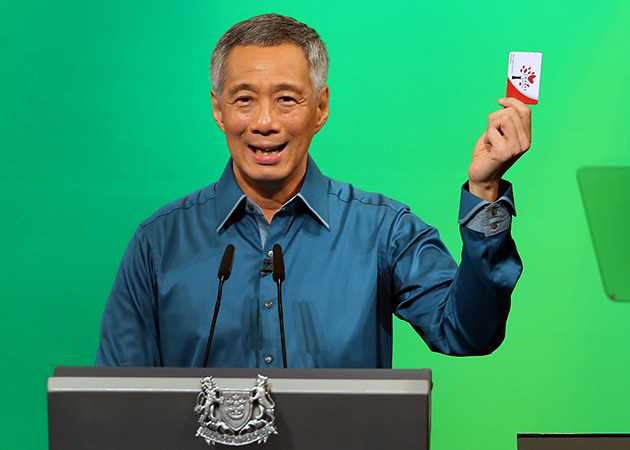

PM Lee at National Day Rally 2014 (courtesy of Prime Minister’s Office)

Prime Minister Lee Hsien Loong’s recent National Day Rally speech got me thinking about the challenges of planning for one’s retirement. Are Singaporeans aware of how much funds they need to retire comfortably? Do they know what their true retirement living costs will be?

I like how PM illustrated the case of a fictitious 54 year old senior technician named Mr Tan, and how his estimated living costs of $2,000 per month could possibly be met. Through the example given, PM showed that a CPF Minimum Sum of $155,000 – to be adjusted to $161,000 next year – isn’t an unreasonable amount to be considered in one’s Retirement Account (RA). In fact it can only cater to a very basic lifestyle and is probably insufficient for those who retire earlier (at say 55 rather than 65 years of age).

For those who aren’t aware, the first $40,000 parked into your RA (which is derived from your Special and Medisave Accounts) and first $20,000 parked into your Ordinary Account (OA) yields an additional 1% annual interest (ie 5% for RA and 3.5% for OA). The remaining sum in the RA yields a 4% interest per annum while the remaining funds in the OA yields a 2.5% annual interest. The Minimum Sum – whatever the quantum – is also the maximum amount that you can top up into the RA either from the Ordinary Account or as cash.

Net Assets, Savings and Investments

Simply put, there are three things to note in determining how well prepared you are for your retirement:

1) How much you already have. In other words, your net assets. While one’s home is theoretically an asset that can be sold, reverse mortgaged or used for a Lease Buyback scheme (HDB four-room or three-room flats), doing so ought to be a last resort.

2) How much you can save. In other words, what is left from your monthly and annual income after deducting all your expenses.

3) The investment returns you are getting from your assets. This may differ significantly, depending on the risks/rewards of the options (these are usually proportional), the loans you take for the investments, the financial stability and security of the organisations you invest with, and the time duration/ maturity dates of the investments.

The first and perhaps most important hurdle in retirement planning is budgeting. Surprisingly, many of us are skilled in planning and managing our budgets at work, yet fail to apply the same discipline and diligence in our personal finances. Without understanding what your spending patterns are like, it will be impossible to plan for your retirement in the future.

Projected Retirement Budget – Comfortable Scenario

How much would a retiree truly need? Well, this varies significantly.

Let us imagine another hypothetical 54 year old, whom we call Mr Yeo, who hopes to retire next year when he hits 55. If he is fairly healthy, lives comfortably, drives, and has no outstanding home or vehicle loans, his projected living costs may look like this:

- Car – $1,500 to $2,000 per month (for a modest Japanese sedan and includes vehicle loan payments, Road Tax, parking, ERP, fuel, insurance, repairs, and other costs). See Money Smart’s article here for the estimate.

- Restaurant/Cafe – $600 per month (assuming 20 meals/drinks of about $30 each per month at restaurants, cafes, and bars)

- Groceries – $300 per month (this is for all home-cooked meals)

- Telco, Utilities and Conservancy Fees – $150 to $200 per month (broad band, mobile, electricity, water, conservancy fees)

- Clothes and Accessories Shopping – $300 per month

- Domestic Helper – $700 to $800 per month (includes levy and other living and sundry expenses like food, etc).

- Healthcare and Medical – approx $80 to $100 per month (supplements, visits to GP, medicine, Chinese herbs, etc).

- Personal Grooming – $50 to $100 per month (hair, facial, toiletries, creams etc)

- Holiday Expenses – $500 per month (assuming $6,000 per year for one long haul trip of about $4,000, two short haul trips of about $1,000 each)

- Gifts and Donations – $200 per month (assuming about $2,400 per year for Christmas/CNY/Hari Raya/Deepavali gifts, donations to charities, and offerings to religious institutions)

This works out to an estimated monthly budget of approximately $4,750 or so, excluding other miscellaneous expenses. If we assume that Mr Yeo lives till an average age of 85 years (Singapore’s life expectancy), the total amount needed could look like this:

- Annual expenses (first year): $57,000

- Expenses over 30 years: approx $1.71 million

Hang on a minute. We forgot to add something very important. Inflation!

If we assume a modest annual inflation rate of 1.8% (based on Singapore’s historical inflation rate of 1.83% over the past 30 years), the total would look like this:

- Annual expenses (first year): $57,000

- Expenses over 30 years (incl 1.8% annual inflation): approx $2.36 million

If we are talking about a retired couple (who share the car and domestic helper), their cumulative expenses over 30 years could easily rise to $3.5 million or more! Bear in mind that while comfortable, the projections above are still fairly conservative. Mr Yeo’s vehicle expenses are based on a Corolla Altis and not a Mercedes, and his restaurant bills are on the low side.

Projected Retirement Budget – Spartan Scenario

Of course, one always has the option of further scaling down one’s expenses. Based on the above scenario, it is possible to drastically trim one’s monthly expenses by about 70% to approx $1,400 if the following adjustments are made:

– Travel by bus or MRT (-$1,650 based on the same Money Smart article here)

– DIY without a maid (-$750)

– Substitute 20 restaurant meals with hawker meals (-$480)

– Omit all holidays and explore Singapore (-$500)

Using the same assumptions (1.8% inflation, 30 years lifespan post retirement), the total amounts needed would then be very different:

- Annual expenses (first year): $1,400 x 12 = $16,800

- Expenses over 30 years (incl 1.8% annual inflation): approx $700,000

For a retired couple, this works out to about $1.4 million or so, which is two and a half times lower than the earlier “comfortable scenario”. While this looks a lot more feasible for most Singaporeans to attain, it does entail some sacrifice in the life quality of one’s golden years.

Questions to Ask For Retirement

You can see from the two scenarios above that owning a vehicle is a very expensive option. While I have budgeted $600 a month for restaurant meals in the first scenario, this amount is unlikely to be enough for retirees who wine and dine often. Finally, not all retirees need a maid. However, those in their mid 70s and above are quite likely to need extra help as their mobility and health decreases.

With the above scenarios in mind, it may be useful to ask ourselves the following questions:

- Have we saved enough for our golden years, bearing in mind that we may live another two to three decades after we stop work?

- Can we realistically scale down our expectations when we hit our retirement age? Don’t forget that you will have a lot more free time to shop, dine out and travel! 🙂

- Will our funds generate sufficient returns to cater to our retirement living expenses?

- Do we want to bequeath anything to our children or grandchildren? While we can theoretically do lease buyback on our HDB flat to get some cash, doing so may mean that our descendents will not have the immediate assurance of inheriting a roof over their heads.

If you haven’t already done so, I’d strongly recommend you to work out how much you are spending on a monthly and annual basis. Get a handle on the sums you need for your lifestyle, see how it all adds up, and determine if you have sufficient funds set aside for retirement.

For my next post, I will share my thoughts on getting a better grip on the different investment options available, as well as managing your portfolio.

Disclaimer: The above information are provided purely for illustrative purposes and do not constitute professional financial or investment advice.

2 Comments