Have you wondered if this current crisis is going to be bigger than the rest? Or whether the financial stimuli provided by the G8 nations are enough to pull us out of this mess?

Well, I found out some of the answers yesterday at a talk on Understanding the Global Financial Crisis organised by the Civil Service College. Part of the MTI-CSC Economics Speaker Series, it featured Professor Bradford DeLong (a rather prolific blogger I must add) who is the Professor of Economics at U.C Berkeley. Professor DeLong once served as the Deputy Assistant Secretary for the Treasury under the Clinton Administration.

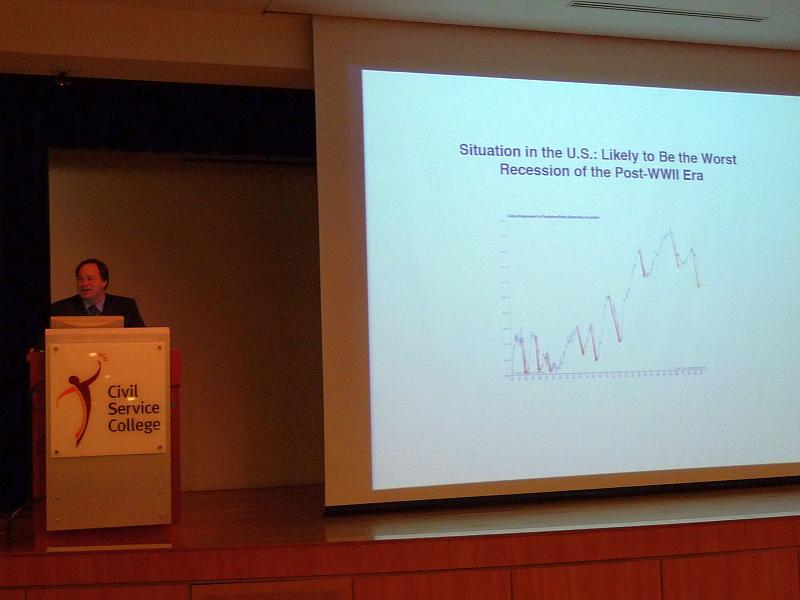

I learnt that we are in the midst of the worst economic downturn since the Great Depression in the 1930s (and the worst post WWII). What makes this more formidable is that it is a non-standard recession, ie it cannot be saved by adjusting monetary policy alone (ie adjusting interest rates and issuing treasury bonds). It is likely that growth in the US economy will only take place earliest in 3Q 2009.

According to Professor DeLong, the total financial markets is currently close to about US$80 Trillion about a year and a half ago. Today, the total value is about US$60 Trillion. This is due to four discount factors:

1) A Default Discount of about US$2 Tril from Mortgages, and another US$4 Tril from other recession losses (total loss of US$6 Trillion)

2) A Duration Discount (ie moves by central banks to increase liquidity) which adds about US$3 Trill to corporate coffers. (ie adding US$3 Trillion to the bill)

3) A Risk Discount and…

4) …Information Discount of about US$17 Trillion

The chilling part about this is that the actual losses from people who can’t pay their housing debts are much less than the tremendous fall in risk tolerance and its cascading effects on overall sentiment. In other words, people prefer to liquidate their financial assets for something more short term but less risky.

This is why the prices of commodities have risen, as these goods are more tradeable in the open markets. In today’s economy, the bulk of assets – buildings, organisations, intellectual and human capital, distribution chains – cannot be easily monetised and sold off in the open market. Of course, in a risky environment cash is king and people may start to keep money under their pillows!

This then leads to a Catch 22 situation. Banks and financial companies need to de-leverage in order to pay their investors, but their finance-backed stocks and companies cannot be easily liquidated. This is unlike the pre 1800s, when a merchant could easily unload his goods and sell them off for money to pay his creditors.

How did it all happen? There are four causes for the current global financial malady:

1) Capital impairment. In other words, a situation where a stock insurer must invade its capital account in order to meet its obligations.

2) Increase in fundamental risk. We are living in a much more uncertain world, and prone to Black Swan and other effects (earthquakes, hurricanes, fires, terrorism etc).

3) Irrational pessimism. This is exacerbated by “herd thinking” amongst human beings.

4) Previous irrational exuberance which led to an over-enthusiastic accumulation of capital.

The problem is that there isn’t enough money to go around. Assets of low duration (ie easily liquidated in the short-term) and significant value are few and far between (who buys commodities nowadays?). That shortage leads to a crash in risky asset prices as investors sell them quickly for short-term cash.

What is the standard government solution to all this? A four-step programme:

1) Reassure investors that the risks are not that great. This could be done by providing a ready life-line of cash injection to financial institutions.

2) Push up financial asset prices by making long-term bonds scarce, and short-term cash more readily available. This is an instrument by central banks to boost prices of shorter-term assets.

3) Reduce the amount of risks by guaranteeing and in some cases nationalising financial institutions on the verge of collapse.

4) Recapitalise the financial markets by having the government take minority shares in banks and big companies.

After trying all this, it appears that the global contagion is still not contained. Prof DeLong proposes another further 3 (more drastic) steps as follows:

5) Massive purchases of risky assets by governments to bring down the amount of risk that the private sector must bear. This is in line with the reduced risk appetites of the private financial systems.

6) Nationalisation (Sweden in 1992) where large chunks of global financial system is brought under government control (and later reprivatised).

7) Massive government spending and development programmes as the private sector may be too shell-shocked to finance anything for the next few years.

The question is whether this will all work. It appears to be advocating a strong degree of government involvement in the economy – not exactly what a free-wheeling capitalist world should look at.

For a start, there are certain roadblocks which could be fueled by ideological and intellectual opposition. Professor DeLong highlighted the Marx-Hoover-Hayek Axis, where the distinguished gentlemen generally opposed any moves by central banks taking on a major role in remedying financial markets. The US Republication Party is also generally against any moves which limits the free movement of markets.

There are also individuals who regard the bailing out of financial firms as travesty. This is because the “greedy sinners” of Wall Street should be adequately punished for bankrupting the system. However, Prof DeLong subscribes to the view of Martin Wolf (Financial Times) who said that we shouldn’t treat the economy as a morality tale.

However, these are different times. Markets are not infallible and cannot be left to fend for themselves. Intervention is needed, and governments should treat it as a technocratic challenge – not a moral or religious one. New regulatory reforms are needed, and the lack of theoretical and academic anchors only means that bold and unprecedented moves must be made.

What do you think of Prof DeLong’s strategies? Will they work?

Embedded below is a copy of Prof DeLong’s slides. You can also get a copy of his paper here.

$3 million of freewheeling spending by UC President Yudof/UCB Chancellor Yudof on consultants when the work can be done internally. Save UC and UCB $3 million and do the work of the consultants internally. World class faculty and staff and the UCB Academic Senate are capable of doing the work internally.

As an aside, it is a recession: do your job UCB Chancellor; do your job UC President Youdof